Direct Universal Care (DUC) is the Answer to the Healthcare Finance Crisis

Yeah,yeah. Quack quack, DPC

Introduction

Normally, we talk about healthcare and health insurance and today is no different. Today we are going to discuss using our software to offer patients Direct Universal Care (DUC). This is a lot like Direct Primary Care (DPC) but we will talk about why you can’t have DPC and why you can have DUC. We will also go over how the system works, the software that is already produced to make it all spin, and why our solution is better, faster and cheaper than any other combination of software and health insurance.

What is DUC and DPC?

For years we have been hearing about Direct Primary Care (DPC) as a way to cut costs and get better access to healthcare. DPC is a healthcare model where physicians partner with their patients to provide primary care services under a flat, periodic membership fee. That obviates the need for billing traditional insurance companies for your primary care and saves you as the patient. This is the good part, the Direct part.

The not-so-great part is the Primary part. DPC only applies to your primary care. If you have some kind of surgery or an accident requiring something outside your primary care, you don’t get it. You have to either have a catastrophic insurance policy to go with your DPC or do without major services, the thing you buy health insurance for. Let’s look at some numbers.

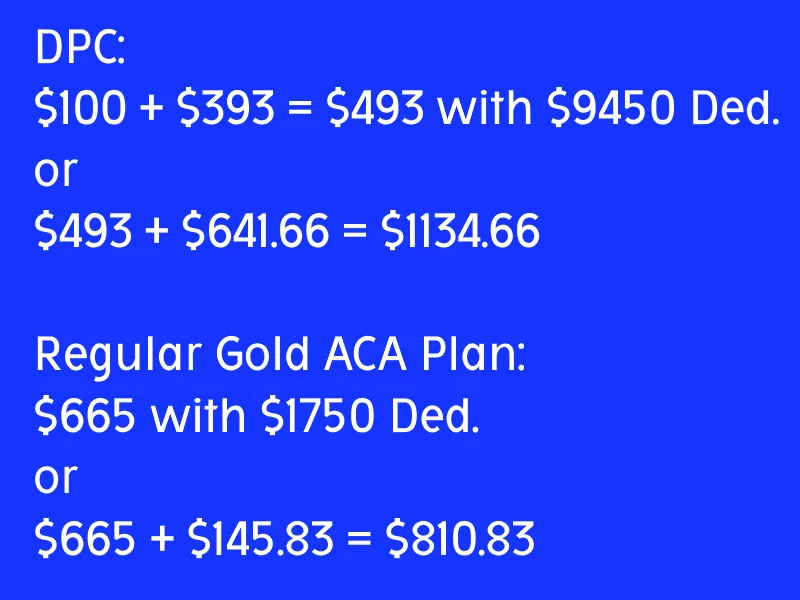

Most DPC services run between $50 and $150 per month for a membership. We’ll split the difference at $100 for the sake of easy calculations. We said you need a catastrophic policy to go with that primary care. According to Forbes on 9/23/2025 the average catastrophic policy costs $393 per month. We averaged the ten year tranches of data (21-60) omitting the 27 year old as skewing the numbers toward the young. The deductible is apparently limited by law to $9450.00 for the individual. According to Forbes on 3/10/2025 the average total coverage premium with a gold plan from healthcare.gov, eschewing the same 27 year old as irrelevant is $665 per month. Sounds like the DPC is a far better deal, almost a third lower, right? The average deductible for that gold plan that covers everything is about $1750.00. If something does happen, your catastrophic policy will actually keep you from going to the hospital because you can’t afford that $9450 deductible. Further, that deductible renews every year. If you want to make the catastrophic insurance equivalent, you need to have the difference in reserve in cash. Every year. $9450 - $1750 = $7700. To make these two equivalent you need to save an additional $641.66 per month ($7700 / 12) to account for the increased deductible.

DPC doesn’t sound so good now does it?

What About DUC, Though?

So the DPC doctors had a fantastic idea: cut out the Finance Bros altogether and offer their services Directly (the good part). They didn’t figure on a catastrophic policy being so expensive. A hospital however wouldn't have this problem. A hospital can provide Universal care, or at least know where to ship you off to to get it. That avoids the need for a catastrophic policy.

Here is what we need to put that together. First we do need primary care and we do need primary care doctors. We don’t want to run to the hospital for a lipid panel or a runny nose. We need primary care physicians. We also need those services that the hospital provides. We need a partnership between these two classes of entities. Luckily, we already have that. Primary Care Physicians (PCPs) have admitting privileges to nearby hospitals.

Next, we need to break the population into the aforementioned ten year tranches and calculate risk. This is exactly what your insurance company does and you already pay for. Read that again, you already pay for the risk.

Finally, We at Sentia have designed and built a robust, fault tolerant, fast, Electronic Medical Records System (EMR), that we can provide for less than a tenth of the cost of an Epic or an Oracle/Cerner. Read this for an analysis of what EMR vendors are all doing wrong and how we have fixed it. This EMR is universal, with no need for training, one page to document care and no specialties. Here is a demonstration of the EMR in action. It is based on the Universal Medical Language System (UMLS) that gives it this flexibility and one reason we say that Epic and Cerner are just doing it wrong. As the patient encounter is documented, we can pull the payment for the service out of the risk pool and pay for your healthcare, automatically, with no insurance rigamarole needed.

DUC Financials

We have estimated and documented dozens of times the fact that your health insurance company wastes more than half your premium. Let’s dig into what that means for the hospital, the primary care practice, the patient, and of course the big insurance companies.

Hospital Benefits

Hospitals immediately get 90% savings on the EMR. Hospitals also get the savings of not having to deal with insurance companies, if they don’t want to. Of course our system can be used with traditional, legacy, wasteful, health insurance, but once you see the benefit to the patient, those legacy companies will file bankruptcy and simply go away. Part of our Hospital EMR is an ERP style Hospital management system that will allow the administration to look at a Profit and Loss Statement (P&L) on every procedure, doctor, room, department or any combination of those, with the click of a button. That allows them to find the cash leaks and inefficiencies and not only make them more profitable, but the care more affordable. Doctors can pull up lists of at risk patients by any criteria. Want to look at pregnant women with a diastolic over 90? Fine. Appendectomy and sepsis? Fine. Anything.

Primary Care Practice Benefits

The PCPs will see the same 90% reduction in cost for the EMR and the ERP style practice management system is exactly the same as the hospital management system, making them just as streamlined and efficient. They also get to not deal with the legacy insurance companies if they do not care to. All patient information is shared between practice and hospital as well, along with other practices and hospitals in the system. More on that in the Patient Benefits section.

Patient Benefits

The patient pays exactly $10 per month to Sentia for the privilege of managing their healthcare records. The patient also pays for their own risk, but they already are. We have divorced the risk from the payment for service. Read this for the details of this separation of service and risk. The patient can see their own medical records at home across the internet. They can see their xRays and MRIs. they get a built in health and wellness system. They can see the physician’s notes. They can email the physician. They can schedule an appointment. They can fill out custom questionnaires designed by the practice at home without pen and paper. They can see the entirety of their own records, just not modify them. They can also grant access to another physician.

Big Insurance Companies

Since the big insurance companies don't have any input into this process and don’t make any profit, they can go bankrupt and simply disappear. That way we get rid of the 50% of your premium that they either waste or wad up and put in their pockets. We are going to do everything we can to ensure they are put out of business.

What this Means

The title of this section was financials and we haven’t even really talked about them yet.

The average practitioner spends about $73,000 per year on the combination of EMR, medical coding and compliance reporting to the government. All of that evaporates like morning dew on grass.

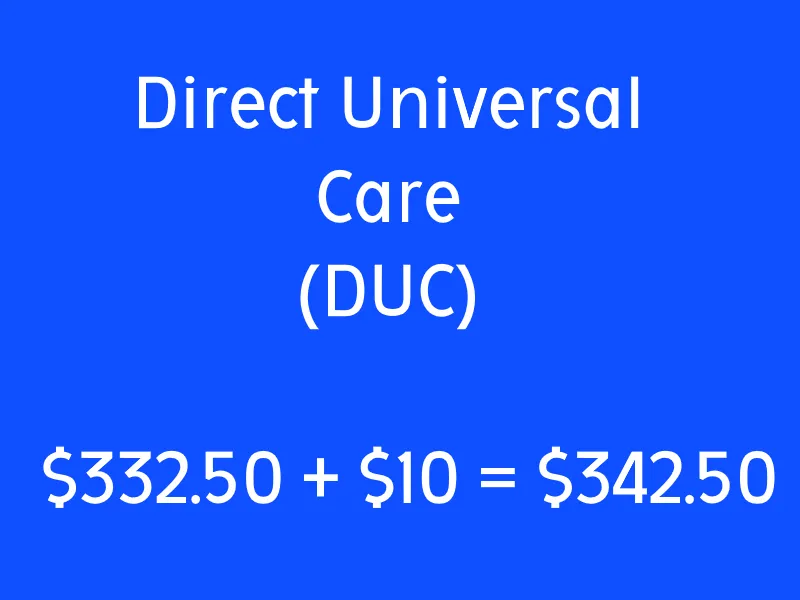

Further, the patient's bill for health insurance goes down by about 50%. If the average cost of the risk is $332.50 and we add $10 for data management, we get $342.50 per month.

That doesn’t include the savings from the practitioners, practice or hospital perspectives, but it does sound a hell of a lot better than $1134 per month or even $810 per month. It sounds like far less than half, because of the inclusion of the deductibles.

Caveats

We will have to account for the procedures that your local hospital doesn’t accommodate and of course some things happen away from home. These should be fairly simple to calculate the risk for and just add to the tranche’s risk calculation. I foresee 3-5% of the risk for these occurrences, far less than out-of-network prices your traditional, legacy, manual, inelegant, wasteful current insurance charges.

Conclusions

We have shown a way to save well over half from the cost of healthcare. We have shown a way to streamline and automate both health insurance and healthcare administration and delivery. We have shown a way to relieve practitioners from the burden of having to deal with the financial side of healthcare. We have detailed Direct Universal Care (DUC) how it works, what it does and why it is better, faster and less expensive for everyone.

Whether we implement DUC or let Sentia provide the health insurance and automated framework to make it all run, this is the only viable path forward. There is no future with the big insurance payers. They will continue to get more expensive and deny more care and kill more and more people until, well, the shooting has already started.

This is the only viable way.

If you liked what you read, please like and subscribe, click on the notification icon, subscribe to our newsletter, and follow us on all our social media and blog sites.

If you have comments, contact us here, on our site, SentiaHealth.com, our parent company SentiaSystems.com, or send us an email to info@sentiasystems.com or info@sentiahealth.com.

Comment

| Date Written | Comment |

|---|